When you purchase an insurance policy, you trust that your insurer will act in good faith, honoring their commitments when you need them most. However, that trust can be shattered if an insurer operates in “bad faith.” Bad faith insurance refers to an insurer’s refusal to fulfill its obligations per the policy agreement, often leaving policyholders in financial, emotional, and physical distress.

Understanding how insurers can be held liable for bad faith is crucial, especially if you’re navigating a denied claim. At Lenahan & Dempsey, we understand how challenging this situation can be. With a proven track record of recovering countless millions for clients across Pennsylvania, we are here to help hold insurers accountable.

Here, we’ll explore three key ways insurers may be liable for bad faith actions, helping you understand your rights and the steps you can take to protect yourself. In recent years, bad faith insurance claims have been on the rise. Your situation may be the next case.

1. Failing to Properly Investigate a Claim

When you file an insurance claim, you expect the insurer to conduct a thorough and fair investigation. This process includes reviewing your claim details, assessing evidence, and ultimately consulting with attorneys.

What Constitutes Proper Investigation?

A proper investigation should involve:

- Collecting all necessary documents from the insured.

- Reviewing evidence such as photographs, medical reports, and witness statements.

- Consulting medical professionals if required (e.g., medical evaluators).

- Assessing the claim objectively without bias or omission.

Examples of Improper Investigations

Bad faith occurs when insurers:

- Ignore critical evidence that supports your claim.

- Fail to request necessary documents, leading to an incomplete assessment.

- Deny a claim without providing clear reasons or justification.

- Use flawed or outdated methods to evaluate a claim.

For instance, if you submit a car insurance claim after an accident and the insurer ignores witness statements or dismisses critical repairs without inspection, they may be acting in bad faith.

Liability for Insurers

An insurer failing to conduct a proper investigation is a direct breach of its duty to act in good faith under your insurance contract. Legal action may hold the insurer accountable, ensuring fairness and compensation for policyholders.

2. Misrepresenting Policy Terms

Insurance policies can be complex, but insurers are legally obligated to provide accurate and truthful information about your coverage. Unfortunately, some insurers intentionally misrepresent policy terms to deny or minimize valid claims.

What Does Misrepresentation Look Like?

- Claiming certain damages or incidents aren’t covered when they fall within the policy’s terms.

- Providing vague or misleading explanations for a denial.

- Altering or omitting details of coverage after an incident occurs.

Why Insurers Are Liable

Misrepresentation invalidates trust and breaches the policy agreement. Courts take these cases seriously as they reveal unethical practices designed to harm policyholders. Victims of such actions can seek legal recourse for compensation and even punitive damages.

3. Unreasonable Delays in Payment

When a claim is approved, timely payment is a necessity—not a favor. Policyholders often depend on insurance payouts to manage medical bills, property repairs, or other urgent expenses. Therefore, unreasonably delaying payments without cause is one of the clearest indicators of bad faith.

What Constitutes an “Unreasonable” Delay?

Delay tactics used by insurers may include:

- Requiring excessive and unnecessary documentation.

- Routinely “losing” paperwork to slow down the process.

- Failing to respond to inquiries or provide updates.

- Denying claims, only to approve them after prolonged appeals.

These practices can take weeks, months, or even years, pushing insured individuals into financial hardship.

The Impact on Policyholders

Unreasonable delays in payment can have a domino effect:

- Mounting unpaid medical or repair bills.

- Higher financial strain if policyholders need to borrow money.

- Emotional stress and frustration from the prolonged process.

For example, if someone was hurt in a car accident and the insurer delays processing funds for medical bills from recovery, it can leave them without the medicine they need.

Holding Insurers Accountable

When insurers delay payments unfairly, they risk breaching their contract obligations. Courts may demand immediate payouts, and if the Court finds the insurer acted in bad faith, may award additional damages for the unnecessary hardship caused to the insured, including attorneys’ fees, interest, and punitive damages.

We Are The Insurance Bad Faith Law Firm

Lenahan & Dempsey is at the forefront of Insurance Bad Faith cases in Pennsylvania.

Attorney Timothy Lenahan, Managing Partner at Lenahan & Dempsey, along with Attorney Christine S. Lezinski, were the trial and appellate legal counsel in the landmark case of Hollock v Erie. This case, which we won in front of the Pennsylvania Supreme Court, helped establish Bad Faith laws in Pennsylvania.

Thanks to Attorney Lenahan’s and Attorney Lezinski’s efforts and legal skills, this groundbreaking case established the right of individuals to be treated fairly by their insurance companies and, when they fail to do so, insurance companies can be held liable for often severe penalties known as “punitive damages,” which can be far in excess of the value of the original insurance claim.

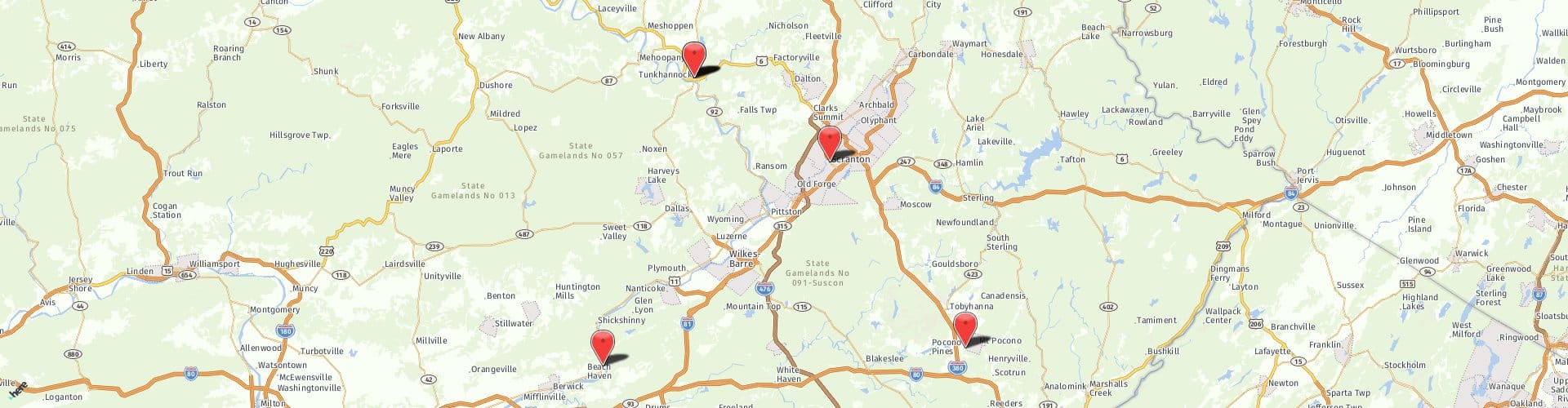

Attorney Timothy Lenahan was named by Best Lawyers In America as the Insurance Lawyer of the year for 2024-2025 for his work protecting the rights of the injured against giant insurance companies for the region of Northeastern/Central Pennsylvania and the Pocono Mountains. He is a past Best Lawyers in America Personal Injury Lawyer of the Year for that region for his work fighting for the rights of injured people.

Eight of our lawyers have been named to both Best Lawyers in America as well as Pennsylvania Super Lawyers. Three, John R. Lenahan, Jr (our Firm President), Timothy Lenahan, and Matthew Dempsey are named to The Top 100 Lawyers in Pennsylvania (out of over 48,000 lawyers in Pennsylvania).

Our success in winning Hundreds and Hundreds of Millions for our clients has also led to Judges and our peers voting us for inclusion in The Best Law Firms in America, and we are listed as a Tier 1 law firm (the highest rating).

Because the attorneys from Lenahan & Dempsey were counsel in a landmark Hollock case that established bad faith rules in Pennsylvania, we are uniquely qualified to fight for you if you are the victim of Insurance Bad Faith.

Protect Yourself Against Bad Faith Insurance Practices With Lenahan & Dempsey

If you believe your insurance provider is acting in bad faith, the law is on your side. At Lenahan & Dempsey, we fight insurance misconduct to get policyholders what’s rightfully theirs. With a long history of success and recognition, our team of injury attorneys is here to guide you through this difficult time.

Don’t face bad faith insurance practices alone. Contact Lenahan & Dempsey today for a free consultation and discover how we can fight to protect your rights.

*Details on Settlements & Verdicts are found at LenahanDempsey.com. All law firms are required to note that because the facts of each case are different, past performance is not a promise of a future outcome.