Underinsured Motorist Claims

Who hasn’t seen the television ads for low-cost auto or truck insurance that meets only the Pennsylvania minimum requirements for automobile liability insurance coverage? That insurance is cheap for a reason – it often doesn’t begin to cover medical expenses, wage loss, pain and suffering and other damages an injured person can suffer after a vehicle accident. That’s when Lenahan & Dempsey steps in to get our clients the money they deserve -- by making a claim for “Underinsured Motorist Benefits.”

Underinsured Motorist coverage is a specific type of insurance coverage you have the option to purchase under your own automobile insurance policy to protect you if the driver at fault for the accident does not have enough insurance coverage to pay for all your losses and damages.

Our Firm is listed in Best Law Firms in America because we have successfully and aggressively fought to get our clients the highest possible recoveries, including claims for Underinsured Motorist Benefits.

We know how to get the best possible results for you in Underinsured Motorist cases due to our history and understanding of often highly complicated insurance law.

Underinsured Motorist Claims Briefly Explained

An Underinsured Motorist Claim is when a person is injured in a vehicle accident caused by a driver who does not have enough insurance coverage to cover the damages they have caused. In these cases, Lenahan & Dempsey lawyers help the injured person seek compensation for Underinsured Motorist benefits. An Underinsured Motorist Claim can be made under the insurance policy covering the car they are occupying at the time of the accident under certain circumstances and/or under the injured person’s own automobile insurance policy or the policy for residents in their household, if Underinsured Motorist coverage was purchased.

In Pennsylvania, Underinsured Motorist coverage is optional, meaning that you are not required to purchase these benefits under your automobile insurance policy, or you can purchase reduced amounts of coverage. Sometimes, insurance agents or insurance companies will suggest that you reduce the amount of Underinsured Motorist coverage under your policy, or reject it entirely, to save money on premiums. However, Underinsured Motorist coverage can make a significant difference in protecting your rights and securing the money you need and deserve.

Underinsured Motorist coverage adds a layer of protection in the event of a serious car accident. Without this coverage, you may be left with limited options for seeking compensation if the at-fault driver's insurance is insufficient to cover your losses. By purchasing sufficient Underinsured Motorist coverage under your own automobile insurance policy, you can safeguard yourself and relatives in your household against financial hardship and ensure that you have the means to recover from a devastating accident.

We Can Help

The very first step in an Underinsured Motorist Claim is to have our legal team vigorously investigate the accident itself – gathering all the information we need to prove you were the injured party.

We then carefully review your insurance policy to determine the extent of your Underinsured Coverage and any specific procedures that must be followed under the insurance policy to file a claim on your behalf.

Even if your insurance policy states that you do not have Underinsured Motorist Coverage, if the insurance company did not follow certain requirements under Pennsylvania law, it is still sometimes possible for you to obtain Underinsured Motorist benefits. Lenahan & Dempsey lawyers understand this complicated area of law.

The next phase is where Lenahan & Dempsey lawyers do their best work for clients – communicating with and negotiating a settlement with the insurance company, or proceeding to trial if necessary.

Lenahan & Dempsey Credentials

Lenahan & Dempsey is well known among insurers for representing genuinely injured people. As such, insurance companies know they need to take our cases seriously – which can often lead to a faster settlement to help you get your life back on track.

Our success in winning Hundreds and Hundreds of Millions for our clients has led to Judges and our peers voting our firm for inclusion in The Best Law Firms in America, and we are listed as a Tier 1 law firm (the highest rating). Eight of our lawyers are listed in Best Lawyers in America and eight are listed as Pennsylvania Super Lawyers. Three, including Firm President John Lenahan, Jr., Managing Partner Timothy Lenahan and Attorney Matthew Dempsey are listed in The Top 100 Lawyers in Pennsylvania (out of over 48,000 Pennsylvania lawyers).

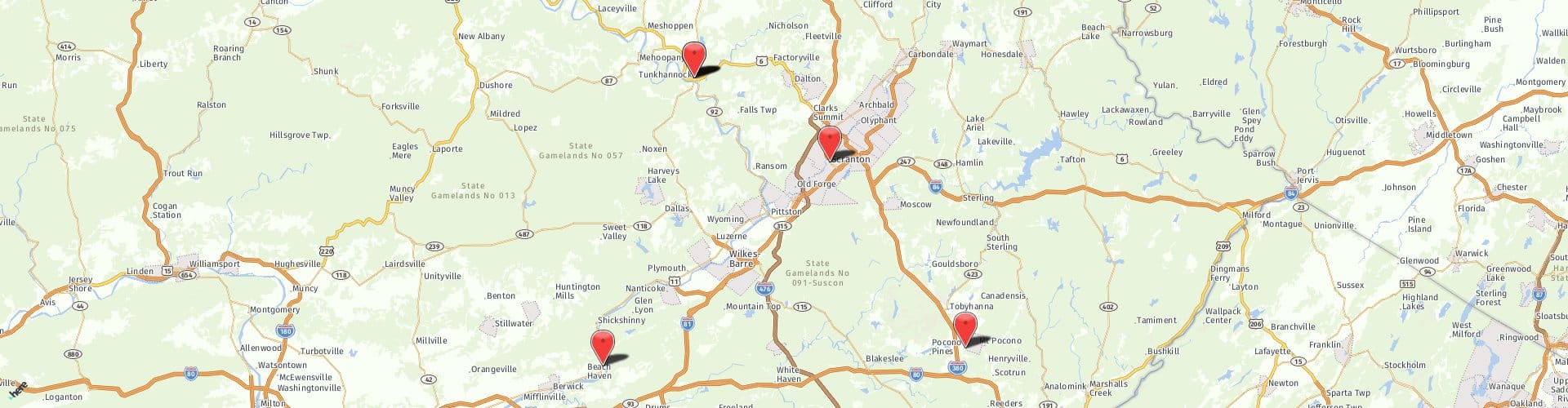

Our Managing Partner, Attorney Timothy Lenahan, is also Best Lawyers in America’s Top Insurance Lawyer for his representation of the injured fighting against large insurers for the region of Northeastern/Central Pennsylvania and the Pocono Mountains. He has previously been named Best Lawyers Top Personal Injury Lawyer for that region for his work fighting for the rights of injured people.

Our team understands all areas of insurance law, including Underinsured Motorist Coverage. We will work aggressively to get you the money you deserve.

Underinsured Motorist Claims and Insurance Bad Faith

Sometimes when an injured party makes an Underinsured Motorist Claim, the insurance company fails to meet its obligations owed to its insured to process and pay the claim in a timely and fair manner. This can give rise to a claim for Insurance Bad Faith against the insurance company. Insurance Bad Faith can involve a wide range of actions, including unreasonably denying a claim, delaying payment without justification, processing the claim unreasonably slowly, or offering an unreasonably low settlement. See more on Insurance Bad Faith here.

Attorney Timothy Lenahan, Managing Partner at Lenahan & Dempsey, along with Attorney Christine S. Lezinski, were the trial and appellate legal counsel in the landmark case of Hollock v Erie. This case, which we won in front of the Pennsylvania Supreme Court, helped establish Bad Faith laws in Pennsylvania.

Thanks to Attorney Lenahan’s and Attorney Lezinski’s efforts and legal skills, this groundbreaking case established the right of individuals to be treated fairly by their insurance companies and, when they fail to do so, insurance companies can be held liable for often severe penalties known as “punitive damages,” which can be far in excess of the value of the original Underinsured Motorist claim.

Call Us

Were you injured by an Underinsured Driver? Call us so we can begin the process to get you the money you deserve. We are available 24 hours a day, 7 days a week at 1.888.536.2328. Call us today for a free, no-obligation case evaluation. There are no fees until you get the money you deserve.

At Lenahan & Dempsey we understand the nuances of Underinsured Motorist Coverage. We have been helping individuals and families across Northeast and Central Pennsylvania and the Pocono Mountains region for 75 years – recovering Hundreds and Hundreds of Millions of Dollars for our clients. That is just one reason we are listed in Best Law Firms in America as a Tier 1 firm for representing the injured.

We will work with you and your family to get you through the process. We’ll handle the details so you can concentrate on your recovery and your family.

What Can You Expect When Working With Lenahan & Dempsey

We have recovered Hundreds and Hundreds of Millions for our clients across almost all fields of Personal Injury, Insurance Bad Faith, and Workers’ Compensation law.

We fully understand the physical, emotional, and financial toll a case can take on victims and their families. Our highly dedicated team of lawyers and paralegals can point to a history of success supporting our clients and winning the money they need to rebuild their lives.

*Best Lawyers in America and Best Law Firms are trademarks of Woodward White. Super Lawyers and Top 100 Lawyers in Pennsylvania are trademarks of Thompson Reuters. Both trademarks are used with permission. Details on Settlements & Verdicts are found at LenahanDempsey.com. All law firms are required to note that because the facts of each case are different, past performance is not a promise of a future outcome.

*Best Lawyers in America and Best Law Firms are trademarks of Woodward White. Super Lawyers and Top 100 Lawyers in Pennsylvania are trademarks of Thompson Reuters. Both trademarks are used with permission. Details on Settlements & Verdicts are found at LenahanDempsey.com. All law firms are required to note that because the facts of each case are different, past performance is not a promise of a future outcome.