Navigating Claims After a Car Accident

A car accident can be a disorienting and stressful experience. In the immediate aftermath, your priority is your health and safety. However, the steps you take in the following hours and days are critical, especially when it comes to dealing with insurance companies. Understanding how to navigate this process can significantly impact the outcome of your claim.

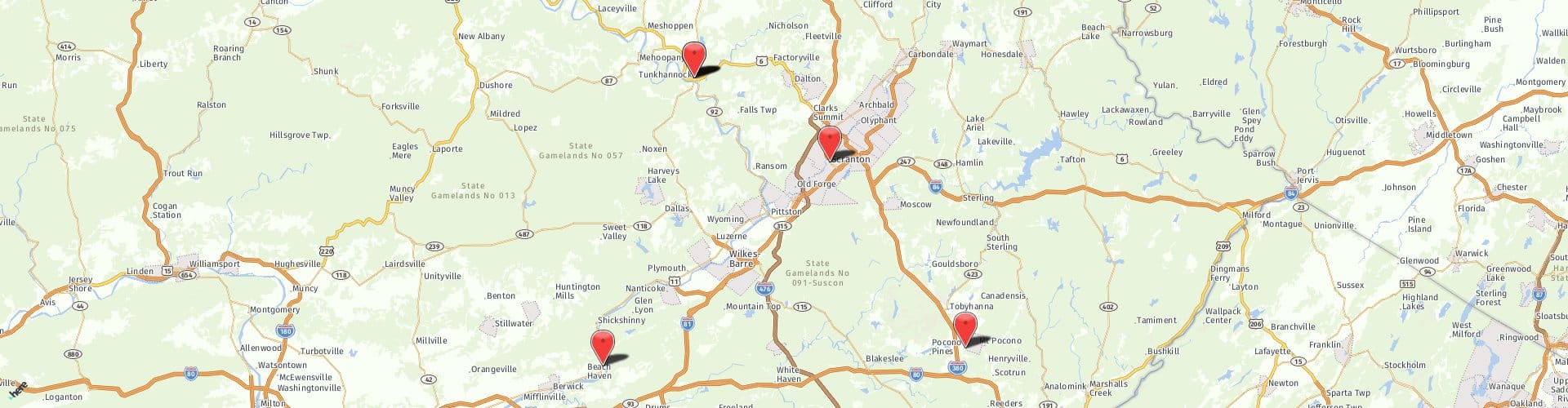

At Lenahan & Dempsey, we have represented the injured in Pennsylvania for decades. We understand the tactics insurance companies employ and are dedicated to ensuring our clients receive the fair compensation they are entitled to. Our guide offers some basic advice on how to handle insurance companies after a car accident.

Immediate Steps After an Accident

Before you even think about speaking with an insurer, there are crucial actions you must take at the scene of the accident to protect your rights.

- Seek Medical Attention: Get a medical evaluation as soon as possible, even if you feel fine. Some injuries, like whiplash or internal trauma, may not present symptoms immediately, which is why prompt medical evaluation is important. Medical records create an essential link between the accident and your injuries.

- Document Everything: If you are able to, while waiting for medical services, use your phone to take photos and videos of the accident scene, including vehicle damage, road conditions, traffic signs, and any visible injuries.

- Gather Information: Obtain the other driver’s name, contact information, driver’s license number, and insurance details. If there are witnesses, ask for their names and contact information as well.

- Obtain a Police Report: Always call the police to the scene, even for what seems like a minor incident. A police report is an official document that provides a neutral account of the accident.

Communicating with Insurance Companies

Once you have addressed your immediate needs, you will need to report the incident. How you communicate with both your insurer and the other party’s insurer is vital.

Reporting to Your Own Insurer

You are contractually obligated to report the accident to your own insurance company promptly. When you call, keep your statements factual and brief.

- Stick to the basic details: the time, date, and location of the accident.

- Explain how the accident happened without speculating on fault.

- Avoid admitting any degree of fault, as even a simple apology can be misinterpreted.

It is also wise to review your policy to understand your coverage, including benefits like medical payments coverage (MedPay) or collision coverage.

Dealing with the Other Driver’s Insurer

The other driver’s insurance company will likely contact you quickly. It is important to remember that their primary goal is to minimize the amount they have to pay.

- Be Cautious: You are not obligated to provide a recorded statement to the other driver’s insurer. Politely decline their request.

- Limit Information: Provide them only with your name and your own insurance company’s information. Let your insurer handle the direct communication.

- Do Not Discuss Injuries: Avoid discussing the specifics of your injuries or medical treatment.

Assessing Damages and Seeking Compensation

To secure a fair settlement, you must have a comprehensive understanding of your damages. This includes more than just the cost of vehicle repairs.

- Document All Expenses: Keep detailed records of all medical bills, prescription costs, and any other out-of-pocket expenses related to your injuries.

- Track Lost Wages: If your injuries prevent you from working, document the time you have missed and the income you have lost.

- Do Not Accept the First Offer: Insurance adjusters often make a low initial offer, hoping you will accept it quickly. Never accept a settlement until you know the full extent of your injuries and damages.

When to Consult a Personal Injury Lawyer

While you can handle minor claims on your own, consulting with an experienced personal injury attorney is strongly recommended, especially if you have sustained injuries. Insurance companies have teams of lawyers working to protect their interests; you should have an attorney protecting yours. An attorney can:

- Manage all communications with the insurance companies.

- Accurately calculate the full value of your claim, including pain and suffering.

- Negotiate effectively to counter lowball settlement offers.

- File a lawsuit if a fair settlement cannot be reached.

Secure the Representation You Deserve

Handling insurance companies after a car accident requires careful documentation, strategic communication, and a thorough understanding of your rights. By taking the correct steps, you can protect your claim and work toward securing the compensation you need to recover.

The attorneys at Lenahan & Dempsey have recovered hundreds of millions of dollars for clients across Pennsylvania. If you have been injured in a car accident, contact us for a free consultation to discuss your case.