Understanding the Two Types of Bad Faith Claims in Insurance

Disputes with insurance companies can be frustrating, especially when you face unfair practices. When insurers fail to honor their obligations, it’s often referred to as “bad faith.” For those involved, understanding the types of bad faith claims can make a world of difference in pursuing justice.

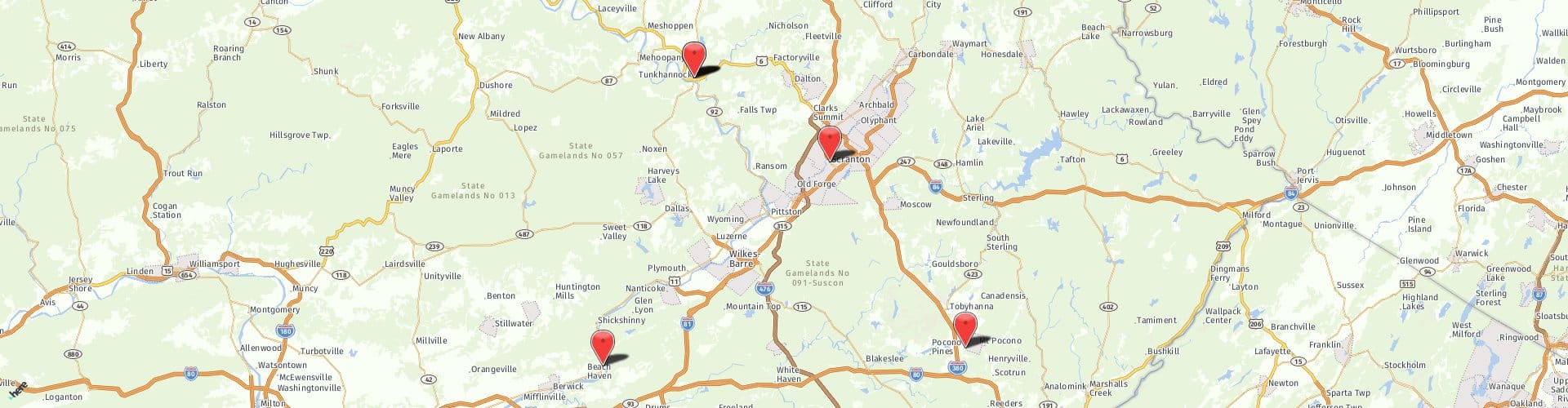

With conveniently located offices in Scranton, Berwick, Tunkhannock, and the Pocono Mountains region, we’re here to help those who have undergone bad faith at the hands of insurance companies across all of Northeastern/Central PA and the Pocono Mountains Region and surrounding counties including cities and towns such as Pittston, Wilkes-Barre, Scranton, Clarks Summit, Dallas, Kingston, Blakeslee, Shickshinny, Dunmore, Carbondale, Nanticoke, Bloomsburg, Hazelton, East Stroudsburg, Mountaintop, Jessup, Forest City, Montrose, and more.

The bad faith insurance attorneys at Lenahan & Dempsey will guide you through the two main categories of bad faith claims in insurance: first-party bad faith and third-party bad faith. We’ll explore their definitions, key differences, and significant legal precedents to help you understand why these distinctions matter.

What Is a Bad Faith Claim in Insurance?

“Bad faith” in insurance refers to instances where an insurer fails to uphold its obligations under a policy, either to the policyholder or to a third party. Insurance companies have a legal duty to act fairly and in good faith when handling claims. If they fail to meet this standard, they can face lawsuits for bad faith.

There are two primary types of bad faith claims:

- First-party bad faith refers to disputes between an insurer and its policyholder.

- Third-party bad faith involves the insurer’s handling of claims made against its policyholder.

First-Party Bad Faith Claims

First-party bad faith occurs when an insurance company unreasonably denies, delays, or undervalues a claim filed directly by its own policyholder. This typically involves cases where the insured seeks compensation for events like accidents, property damage, or medical expenses.

Examples of First-Party Bad Faith

- Claim Denial Without Justification: An insurer rejects a valid claim without providing a proper reason.

- Unreasonable Delays: The insurance company takes an excessive amount of time to investigate or settle a claim.

- Lowball Offers: The insurer undervalues your claim, offering far less than what’s justified based on the policy.

- Failure to Communicate: Ignoring emails, calls, or requests for updates regarding the claim.

Key Elements of First-Party Bad Faith

The focus of first-party claims is on how the insurer treats its policyholders. It examines whether the insurer acted fairly, promptly, and reasonably while processing the claim.

Imagine you file a claim for water damage to your home caused by a plumbing issue. If your insurer denies the claim without proper investigation or justification, citing vague policy exclusions, this could constitute first-party bad faith.

Third-Party Bad Faith Claims

Third-party bad faith arises when an insurance company fails to properly handle claims made against its policyholder by another party. This typically involves liability coverage, where the insurer is obligated to protect the insured against damages claimed by others.

Examples of Third-Party Bad Faith

- Failure to Settle: An insurer unreasonably refuses to settle a claim within policy limits, exposing the policyholder to financial risk.

- Refusal to Defend: The insurer fails to provide legal defense in a lawsuit despite the policy requiring it.

- Improper Investigation: The insurer neglects to investigate the details of the third-party claim thoroughly.

Key Elements of Third-Party Bad Faith

The focus here shifts to the insurer’s obligation to protect the policyholder from third-party claims. Insurers are expected to act in the best interest of their insured, including settling claims when appropriate to avoid unnecessary liability.

Consider a scenario where you’re involved in a car accident, and the injured party files a lawsuit demanding compensation. If your insurer refuses to settle the claim within your policy’s limits despite overwhelming evidence in the injured party’s favor, and there is a verdict or judgment entered against you in excess of your policy limits, which exposes your financial assets, this could constitute third-party bad faith.

Key Differences Between First-Party and Third-Party Bad Faith Claims

Understanding the distinctions between these two types of claims is crucial. Here’s how they differ:

1. Direct vs. Indirect Relationship

- First-party claims deal directly with the insurer’s treatment of the policyholder.

- Third-party claims involve how the insurer handles claims made by another party against the insured.

2. Claim Origin

- First-party claims originate from the policyholder seeking compensation for their losses (e.g., property damage, personal injury).

- Third-party claims arise when someone else files a claim against the insured, such as in liability or accident cases.

3. Legal Obligations

- Insurers in first-party claims must act in good faith toward the policyholder directly, ensuring fair valuation and timely payments.

- For third-party claims, insurers are required to act in the insured’s best interest, protecting them from excessive financial liability.

Legal and Financial Implications of Bad Faith Claims

Both types of bad faith claims carry significant legal and financial consequences for insurers and policyholders:

Damages

- Compensatory Damages are awarded to cover actual financial losses caused by the insurer’s misconduct.

- Punitive Damages, often much higher, are designed to punish the insurer for egregious behavior.

Hollock v. Erie: The Case That Shaped Pennsylvania Bad Faith Laws

One of the most influential cases in bad faith law is Hollock v. Erie, which helped solidify the rights of policyholders in Pennsylvania.

Attorney Timothy Lenahan, Managing Partner at Lenahan & Dempsey, alongside Attorney Christine S. Lezinski, represented the policyholder in this groundbreaking case. Their victory before the Pennsylvania Superior Court established that insurers acting in bad faith can be held to substantial penalties, including punitive damages far exceeding the original claim’s value.

This case set a precedent for holding insurers accountable, ensuring they uphold their good-faith obligations to policyholders. Attorney Lenahan was later recognized as Insurance Lawyer of the Year by Best Lawyers in America for 2024-2025 for his exceptional contributions to this area of law.

Why Understanding Bad Faith Claims Matters

Navigating an insurance dispute can be intimidating, but understanding the differences between first-party and third-party bad faith claims empowers policyholders to recognize when their rights are being violated.

If you believe you’re a victim of bad faith practices, seeking the advice of a skilled attorney is your best course of action. At Lenahan & Dempsey, we’ve dedicated years to protecting clients like you from unfair treatment by insurance companies.

Contact us today for a consultation and take the first step toward justice.

*Best Lawyers in America and Best Law Firms are trademarks of Woodward White. Both trademarks are used with permission. Details on Settlements & Verdicts are found at LenahanDempsey.com. All law firms are required to note that because the facts of each case are different, past performance is not a promise of a future outcome.