Understanding Bad Faith in Insurance and the Liability It Carries

When you purchase an insurance policy, you’re entering a contract founded on trust. You expect your insurer to act in good faith by honoring the terms of your agreement when the need arises. Unfortunately, that isn’t always the case. Insurance companies sometimes prioritize their bottom line at the expense of their policyholders, leading to what’s known as “insurance bad faith.”

Lenahan & Dempsey, P.C., walks you through three key ways insurers can be held liable for bad faith. You’ll also discover how landmark cases, such as Hollock v. Erie, have shaped bad faith laws and provided policyholders with essential protections.

What Is Insurance Bad Faith?

Bad faith occurs when an insurer deliberately acts against the best interests of its policyholders. This could include refusing to pay a valid claim, delaying the process unjustifiably, or misrepresenting the terms of the policy. Such actions often result in significant financial and emotional distress for the insured party.

To hold insurers accountable, laws around bad faith impose financial penalties, known as punitive damages, against companies that act unreasonably or improperly. At the heart of these laws is a commitment to ensuring fair treatment for policyholders.

1. Unreasonable Claim Denial or Delay

One of the most common examples of bad faith is when an insurer unreasonably denies or delays a legitimate claim.

What Does This Look Like?

- Baseless Denials: Refusing to pay a claim supported by clear policy terms.

- Low Settlement Offers: Offering unreasonably small payouts without justification.

- Delaying Tactics: Prolonging responses or payments to fatigue policyholders into accepting less than they’re entitled to.

For instance, if you file a claim for damage covered under your homeowner’s insurance policy and the insurer denies it without explanation or proof, this could be a case of bad faith.

Why This Matters

Such behavior undermines the purpose of having insurance — to provide timely support during times of need. If an insurer acts unfairly, you have the right to take legal action and may be entitled to punitive damages.

2. Failure to Properly Investigate

An insurer must conduct a thorough and unbiased investigation when you file a claim. Failing to do so can easily cross the line into bad faith.

What Constitutes a Failed Investigation?

- Neglect or Oversight: Ignoring vital evidence that supports a claim.

- Misrepresenting Findings: Presenting inaccurate or skewed results to deny payment.

- Rushed Evaluations: Making a snap judgment without giving the case proper attention.

For example, in cases involving auto accidents, an insurer might dismiss physical evidence or fail to interview witnesses, leading to inadequate claims processing.

Holding Insurers Accountable

When an insurer doesn’t fulfill its investigative duties, it violates the trust that policyholders place in the insurance process. Legal consequences often force insurance companies to prioritize fairness and thoroughness in future claims.

3. Misrepresentation of Policy Terms

Misrepresentation is another act of bad faith that can leave policyholders feeling betrayed and financially stranded. This occurs when an insurer deliberately misleads you about the terms of your policy.

Examples of Policy Misrepresentation

- Withholding Coverage Details: Not disclosing all the benefits you’re entitled to.

- Selective Interpretations: Using ambiguous language in the policy to justify claim denials.

- False Exclusions: Insisting certain damages are not covered when they are.

Imagine a scenario where your auto insurer claims flood damage isn’t covered, despite it being explicitly included in your policy. Such deceitful practices can and should be challenged in court.

Why Policy Misrepresentation Is Severe

When insurers misrepresent policy terms, they erode trust and make it almost impossible for policyholders to make informed decisions. Misrepresentation also sets a dangerous precedent by enabling insurers to avoid accountability, making it critical to hold them to task through legal channels.

The Landmark Case: Hollock v. Erie

If you’re exploring bad faith laws in Pennsylvania, the case of Hollock v. Erie Insurance Exchange is pivotal. This landmark legal battle set critical precedents for bad faith claims, shedding light on policyholders’ rights and insurance companies’ responsibilities.

- The Situation: The policyholder, Hollock, filed a claim with Erie Insurance Exchange and faced unjustified delays, misinterpretations, and wrongful denial of coverage.

- The Counsel: Attorneys Timothy Lenahan and Christine S. Lezinski from Lenahan & Dempsey, P.C. represented Hollock both at the trial and appellate levels. Their legal skills were instrumental in establishing the bad faith actions committed by Erie Insurance Exchange.

- The Outcome: The Pennsylvania Supreme Court upheld a bad faith finding, including awarding $2.8 million in punitive damages to Hollock. This ruling emphasized insurers’ obligation to act fairly and reasonably.

Impact of the Case

Thanks to Hollock v. Erie, Pennsylvania now has clear standards for bad faith. The case established policyholders’ rights to fair treatment and underscored the significant penalties insurers face if they act in bad faith.

Recognizing Excellence in Advocacy

Attorney Timothy Lenahan, Managing Partner at Lenahan & Dempsey, played a pivotal role in this landmark case. Recognized as Insurance Lawyer of the Year by Best Lawyers in America for 2024-2025, Attorney Lenahan has spent decades fighting for the rights of policyholders.

His recognition extends beyond insurance law, as he has also been named Personal Injury Lawyer of the Year. Together with Attorney Christine S. Lezinski, their work on Hollock v. Erie has set a gold standard for advocating against insurance bad faith.

Protecting Your Rights as a Policyholder

When insurers engage in bad faith, they harm more than just your finances; they compromise your trust and peace of mind. Understanding the signs of bad faith, from unreasonable claim delays to policy misrepresentation, empowers you to take informed action.

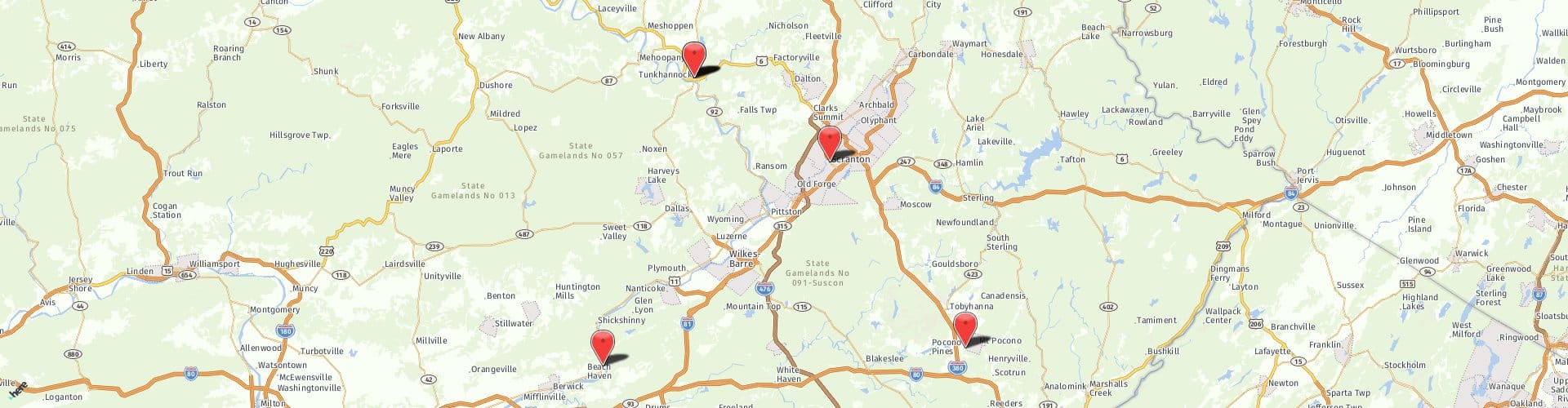

With conveniently located offices in Scranton, Berwick, Tunkhannock, and the Pocono Mountains region, we’re here to help those who have faced bad faith at the hands of insurance companies across all of Northeastern/Central PA and the Pocono Mountains Region and surrounding counties including cities and towns such as Pittston, Wilkes-Barre, Scranton, Clarks Summit, Dallas, Kingston, Blakeslee, Back Mountain, Dunmore, Carbondale, Nanticoke, Bloomsburg, Hazelton, East Stroudsburg, Mountaintop, Jessup, Forest City, and more.

If you suspect you’ve been a victim of bad faith, don’t wait. Seek legal counsel to protect your rights and hold your insurer accountable. At Lenahan & Dempsey, we’re committed to ensuring justice for policyholders across Pennsylvania. Contact us today for help.

*Best Lawyers in America and Best Law Firms are trademarks of Woodward White. Both trademarks are used with permission. Details on Settlements & Verdicts are found at LenahanDempsey.com. All law firms are required to note that because the facts of each case are different, past performance is not a promise of a future outcome.